The U.S. oil and gas sector is a cornerstone of the nation’s energy infrastructure, contributing significantly to economic growth and energy security. Within this vast ecosystem, Engineering, Procurement, and Construction (EPC) companies play a critical role by managing large-scale projects from conception to completion. As the industry evolves, understanding the U.S. Oil & Gas EPC market—its size, market share, and emerging trends—is essential for stakeholders ranging from investors to service providers.

With global energy dynamics shifting and technology transforming traditional operations, EPC contractors face both challenges and opportunities. Keeping abreast of these changes allows companies to optimize project execution, reduce costs, and position themselves competitively. This article delves into the U.S. Oil & Gas EPC market for 2026, offering insights, practical considerations, and key trends shaping the industry.

Understanding the U.S. Oil & Gas EPC Market

The EPC segment in the oil and gas industry encompasses companies responsible for the engineering design, procurement of materials, and construction of oil and gas facilities, including refineries, pipelines, storage terminals, and offshore platforms. These firms are pivotal in translating project concepts into operational assets.

Key Components of EPC Operations

- Engineering: Detailed project planning and design, including feasibility studies, process engineering, and structural design.

- Procurement: Sourcing materials, equipment, and services essential for project completion while ensuring cost-effectiveness.

- Construction: On-site assembly, installation, and commissioning of facilities to meet project specifications and timelines.

By integrating these phases, EPC contractors reduce operational risks, enhance efficiency, and provide end-to-end solutions to clients.

Importance of EPC in the Oil & Gas Sector

EPC contractors are more than just builders—they are strategic partners in a project’s lifecycle. Effective EPC execution ensures projects are delivered safely, within budget, and in compliance with regulatory standards. This becomes increasingly vital as projects grow in complexity and scale.

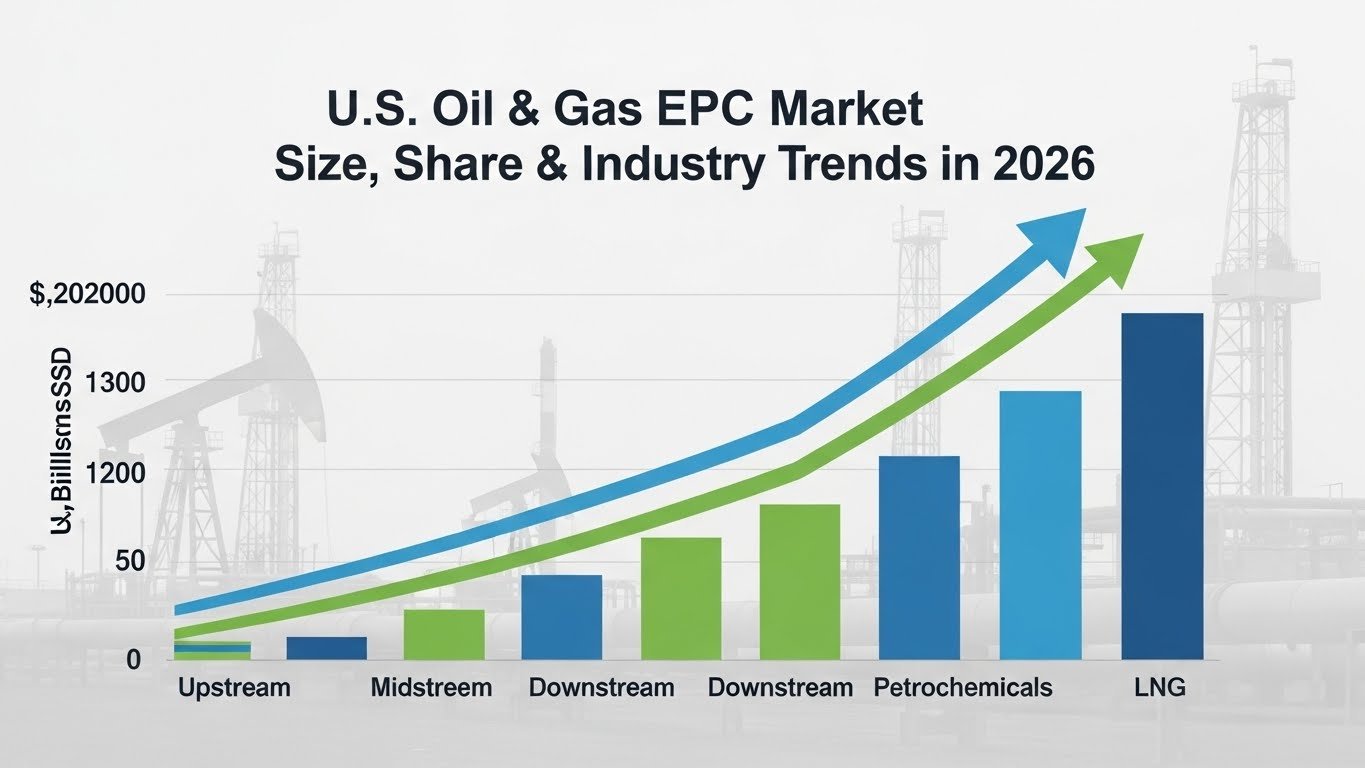

U.S. Oil & Gas EPC Market Size in 2026

The U.S. EPC market for oil and gas is projected to experience steady growth in 2026, driven by rising energy demand, infrastructure modernization, and technological adoption.

Market Overview

- Estimated Market Size: The U.S. EPC market is expected to reach multi-billion-dollar valuations by 2026, reflecting both domestic and international project activity.

- Market Segmentation: Key segments include upstream exploration and production facilities, midstream pipelines, and downstream refineries and petrochemical plants.

- Regional Insights: Texas, Louisiana, and the Gulf Coast region remain hubs for EPC projects due to the concentration of refineries, offshore platforms, and supporting infrastructure.

Growth Drivers

- Energy Demand Recovery: Post-pandemic economic rebound and industrial activity fuel demand for new oil and gas facilities.

- Infrastructure Expansion: Aging pipelines and refineries require upgrades and new construction projects.

- Technological Advancements: Digital twin technology, predictive maintenance, and modular construction improve efficiency and reduce costs.

- Regulatory Incentives: U.S. government policies supporting energy security and sustainability encourage project investment.

The combination of these factors creates a favorable environment for EPC contractors, particularly those capable of delivering complex, high-value projects.

Market Share Analysis

Understanding market share provides insights into competitive positioning and industry concentration.

Key Players and Market Concentration

Several large EPC firms dominate the U.S. oil and gas market, often through vertically integrated services and strong project management capabilities. While international players have a presence, domestic firms retain a significant market share due to local expertise, regulatory familiarity, and established relationships with energy operators.

Opportunities for Smaller Players

Smaller EPC firms and specialized service providers can capture market share by:

- Focusing on niche areas such as renewable integration, pipeline inspection, or modular construction.

- Partnering with larger contractors to provide specialized services efficiently.

- Leveraging digital solutions and automation to reduce project timelines.

These strategies enable smaller players to remain competitive and adapt to evolving market demands.

Key Trends Shaping the U.S. EPC Market

The U.S. Oil & Gas EPC sector is undergoing transformation, driven by technology, policy, and sustainability imperatives.

1. Digital Transformation and Automation

EPC firms are increasingly adopting digital solutions to optimize project execution:

- Project Management Platforms: Real-time monitoring of timelines, budgets, and resources improves decision-making.

- Automation in Construction: Robotics and 3D printing reduce labor costs and construction time.

- Predictive Analytics: Helps identify potential delays or equipment failures before they impact project delivery.

By embracing technology, EPC companies can enhance efficiency, reduce risk, and improve project outcomes.

2. Modular and Prefabricated Construction

Prefabrication of components off-site and modular construction approaches are gaining traction:

- Reduces on-site construction time.

- Enhances quality control and safety.

- Minimizes environmental impact by reducing site disturbances.

This approach is particularly valuable for projects in remote or offshore locations.

3. Sustainability and ESG Focus

Environmental, Social, and Governance (ESG) considerations are increasingly influencing EPC decisions:

- Projects now incorporate emissions reduction strategies, water conservation, and waste management.

- Clients prefer EPC contractors demonstrating strong ESG credentials, boosting competitiveness.

- Renewable integration, such as hybrid energy systems, is becoming part of project planning.

Sustainability is no longer optional—it is a business imperative for long-term success.

4. Increased Demand for Oil & Gas Marketing Services

EPC contractors are exploring value-added services such as oil & gas marketing services to strengthen client relationships and diversify revenue streams. This includes market intelligence, regulatory guidance, and supply chain optimization, providing a more holistic offering beyond traditional EPC scope.

5. Workforce Evolution

Skilled labor shortages remain a challenge, prompting EPC firms to:

- Invest in training programs and apprenticeships.

- Utilize augmented reality (AR) and virtual reality (VR) for remote training and on-site guidance.

- Implement knowledge management systems to retain institutional expertise.

A capable, tech-savvy workforce is essential for delivering complex projects efficiently.

Practical Considerations for EPC Stakeholders

Whether you are an investor, contractor, or service provider, understanding the EPC market dynamics is crucial:

- Evaluate Project Viability: Analyze cost, timelines, and regulatory requirements before committing resources.

- Leverage Technology: Invest in project management tools, digital twins, and predictive analytics to improve outcomes.

- Sustainability Compliance: Incorporate ESG measures early to avoid regulatory delays and enhance reputation.

- Partner Strategically: Collaboration with smaller contractors or technology providers can offer competitive advantages.

- Adapt to Market Trends: Monitor policy changes, energy demand fluctuations, and technology adoption rates to stay ahead of competitors.

By considering these factors, stakeholders can make informed decisions that align with long-term growth strategies.

Outlook for 2026 and Beyond

The U.S. Oil & Gas EPC market is poised for steady growth in 2026, driven by infrastructure expansion, technological adoption, and energy sector recovery. Key expectations include:

- Continued demand for modular and prefabricated construction.

- Greater reliance on digital project management and automation.

- Heightened ESG integration in project design and execution.

- Emerging opportunities in specialized services and market intelligence offerings.

Firms that can navigate these trends while maintaining operational excellence and safety standards will be well-positioned for success. Companies like Centric exemplify the integration of technology and strategy in the EPC landscape, setting benchmarks for efficiency and innovation.

Conclusion

The U.S. Oil & Gas EPC market in 2026 represents a dynamic and evolving sector. With significant opportunities in infrastructure modernization, technological advancement, and ESG integration, EPC contractors must stay ahead of industry trends to remain competitive.

Understanding market size, share, and emerging trends equips stakeholders to make strategic decisions, optimize project execution, and capture growth opportunities. By embracing digital transformation, modular construction, and sustainability practices, EPC firms can thrive in a complex and rapidly changing environment, ensuring that projects are delivered efficiently, safely, and profitably.

As the industry moves forward, continuous adaptation and innovation will define the leaders in the U.S. oil and gas EPC market.